amazon flex quarterly taxes

According to the. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after becoming aware of the FTCs investigation in 2019.

An Amazon Flex Delivery Driver In His 60s Making 120 A Day Shares What It S Like To Work Independently For The Retail Giant Warehouse Automation

The 153 self employed SE Tax is to pay both the employer part and employee.

. The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year. With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes. Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022.

TurboTax Estimated Taxes is your complete estimated income tax solution from figuring to filing. If your payment is 600 or more you will receive a. 12 tax write offs for Amazon Flex drivers.

Calculates Quarterly Tax Estimates on the basis of the already-enrolled information and keeps you on-schedule with payments. I started last March and already did my taxes for 2020. Amazon Flex Drivers are considered 1099 non-employee workers which is a separate taxpayer status from the classic W-2 salaried employees who work for someone else.

There are situations where self-employed individuals or independent contractors have more than one job. However Amazon Flex pay averages 18 to 25 per hour when you include tips. With Amazon Flex you work only when you want to.

Any info is appreciated everyone. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. Choose the blocks that fit your schedule then get back to living your life.

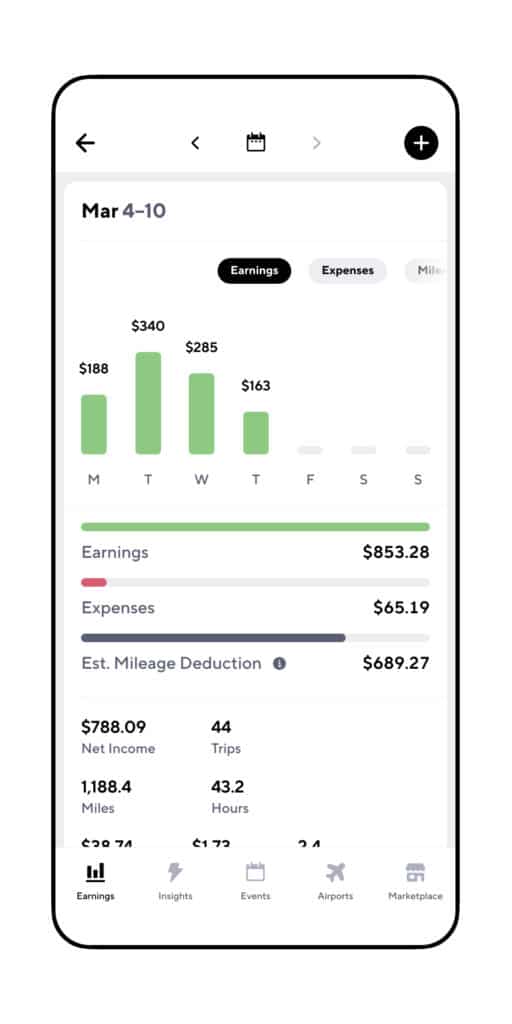

Amazon Flex quartly tax payments. This app makes keeping track of my tax deductions a breeze. It helps eliminate tax-time surprises penalties and finesand minimizes under- and over-payments.

If youre an Amazon seller living in the US then youre probably aware that tax time is coming up. It offers an automatic system that detects when youre driving so you can be sure to log every mile. Increase Your Earnings.

You may also need to file quarterly taxes. Amazon Flex drivers can make between 18 and 25 per hour delivering packages. We are actively recruiting in.

The FTCs complaint alleges that the company stopped its behavior only after becoming aware of the FTCs investigation in 2019. Our guide will help you get started. Just claim the 1099 next year.

Knowing your tax write offs can be a good way to keep that income in your pocket. You only need to do quarterly taxes if youre going to be above 1000 owed on your yearly return. Tips factor into your income making it hard to determine.

Gig Economy Masters Course. Individuals C corporations sole proprietors single-member LLCs or LLCs taxed as corporations are required to file taxes by. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do.

The pay for Amazon Flex drivers depends on the area and type of delivery you make. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone. 12 things that you need to know before delivering with amazon flex this is the best advice for new amazon flex drivers.

FilingPaying Self-Employment Taxes. However if you mean that you were a Delivery Driver and did work for several companies such as Amazon DoorDash Instacart and you only entered some of your income then select Yes to enter your additional income. The Federal Trade Commission will send out more than 60 million to drivers for Amazons Flex program representing tip money that the commission says was illegally withheld.

Whos hip to this. Stride is a cool and free new option for mileage tracking. If so does amazon have a tax form for download every three months now.

Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. If you get a check please cash it before January 7 2022. Driving for Amazon flex can be a good way to earn supplemental income.

But Ive heard that after the first year of self employed income I have to start doing my taxes every quarteris this true for you flex-veterans. Driver support is great in the app while you are delivering but almost non-existent outside of scheduled blocks. Report Inappropriate Content.

Its gone from a chore to something I look forward to. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. Amazon says it always pays you at least 15 19 per scheduled hour.

Amazon will pay more than 617 million to settle Federal Trade Commission charges that it failed to pay Amazon Flex drivers the full amount of tips they received from Amazon customers over a two and a half year period. Enjoy the relief peace of mind and control that come from doing your quarterly estimated income taxes right. Louis MO Boston MA Salt Lake City UT.

Watching my deductions grow. You can plan your week by reserving blocks in advance or picking them each day based on your availability. If youre looking for a place to discuss DSP topics head over to ramazondspdrivers.

After year 1 as an independent contractor you are expected to pay quarterly estimated taxes. This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program.

How To Do Taxes For Amazon Flex Youtube

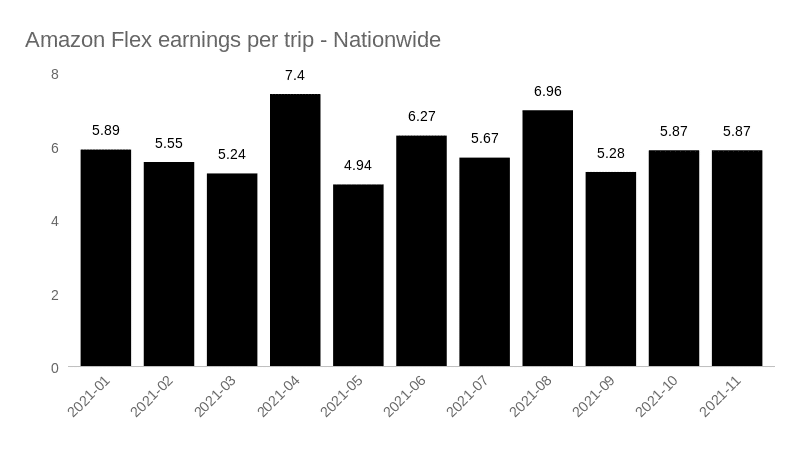

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

How To File Amazon Flex 1099 Taxes The Easy Way

The Best Tips For Amazon Flex Fba Drivers Everlance

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

What Are Income Limits That Will Allow You To Qualify For Medi Cal Or Coveredca Health Plans Income Health Plan How To Plan

Drivers For Amazon Flex Can Wind Up Earning Less Than They Realize The Seattle Times

.jpg/_jcr_content/renditions/cq5dam.web.1440.1440.jpeg)

Ford Flex Discontinued Flex Support Maintenance Plans Ford Ca

The Best Tips For Amazon Flex Fba Drivers Everlance

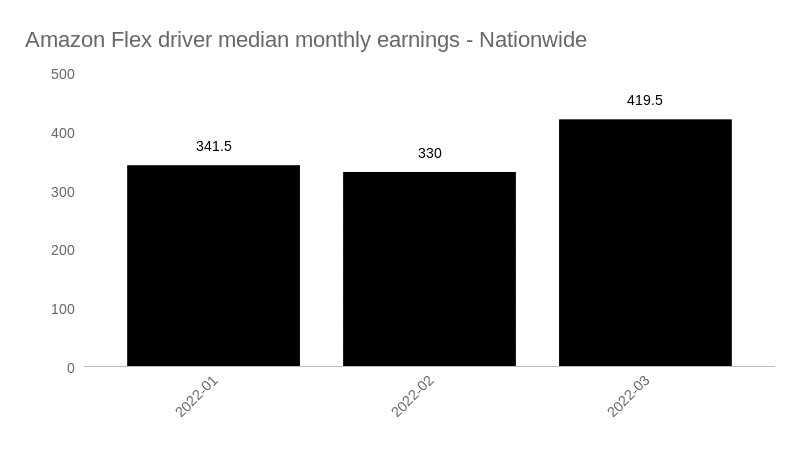

Amazon Flex Driver Pay Q1 2022 What Is Amazon Paying Their Drivers Gridwise

Massdrop Flex Task Chair More Community Picks Other Drop Task Chair Chair Price Chairs For Sale

Drivers For Amazon Flex Can Wind Up Earning Less Than They Realize The Seattle Times